Don’t tell my wife, but I think I’m in love. Federal Reserve Chair Janet Yellen uses a dashboard of jobs data that doesn’t just rely upon a single measure (unemployment rate) to make economic and labor policy decisions. Instead, she uses a dozen different measures to provide a more holistic, more accurate, and hopefully more actionable view of the United States economic situation. She’s a data scientist at heart that realizes that a single measure of anything complex—whether it’s the U.S. economy or even things like customer satisfaction and predictive maintenance—is oversimplifying something to the point of not being useful or actionable.

Don’t tell my wife, but I think I’m in love. Federal Reserve Chair Janet Yellen uses a dashboard of jobs data that doesn’t just rely upon a single measure (unemployment rate) to make economic and labor policy decisions. Instead, she uses a dozen different measures to provide a more holistic, more accurate, and hopefully more actionable view of the United States economic situation. She’s a data scientist at heart that realizes that a single measure of anything complex—whether it’s the U.S. economy or even things like customer satisfaction and predictive maintenance—is oversimplifying something to the point of not being useful or actionable.

Yellen’s Philosophy: The More Jobs Data, the Better

From the article titled “Yellen’s Philosophy: The More Jobs Data, the Better” in the July 17, 2014 issue of Bloomberg Businessweek:

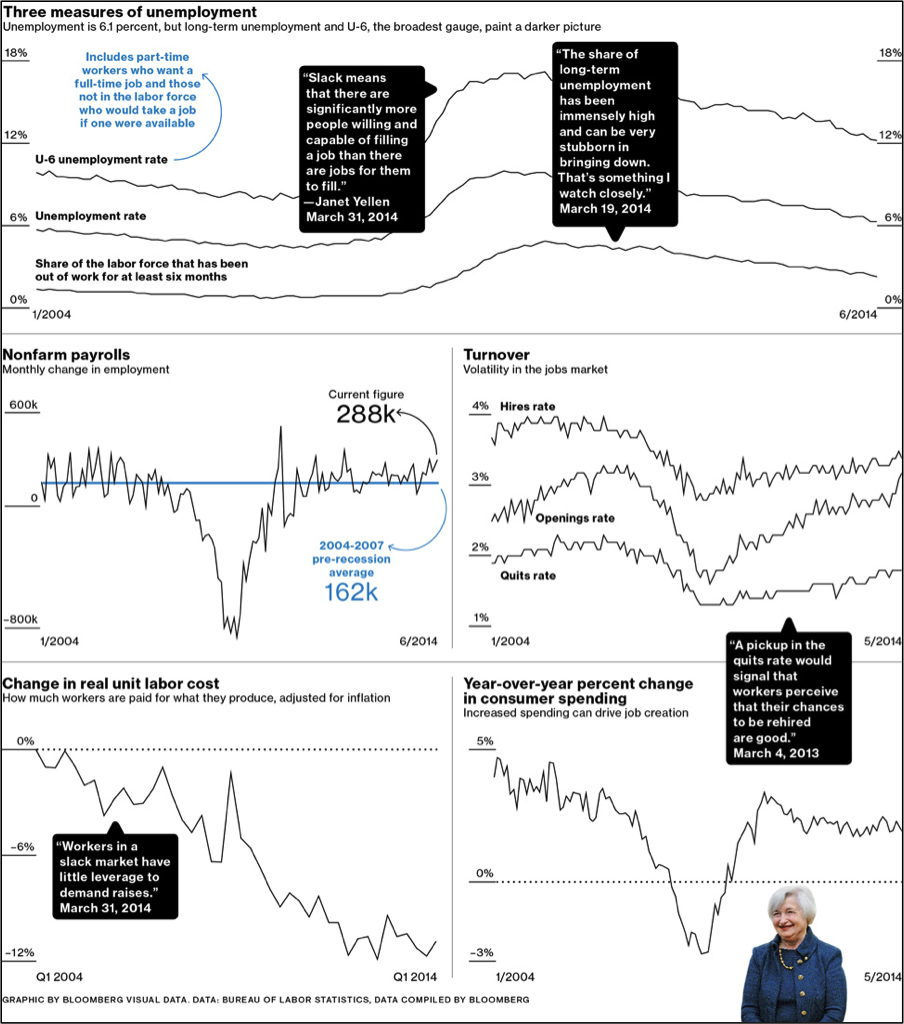

“The unemployment rate, now down to 6.1 percent, indicates strong job growth and a rebounding economy. But Federal Reserve Chair Janet Yellen doesn’t rely on that figure as her sole guide to the job market’s health. In crafting monetary policy, she pays close attention to an array of other gauges on what’s known as Yellen’s jobs dashboard.”

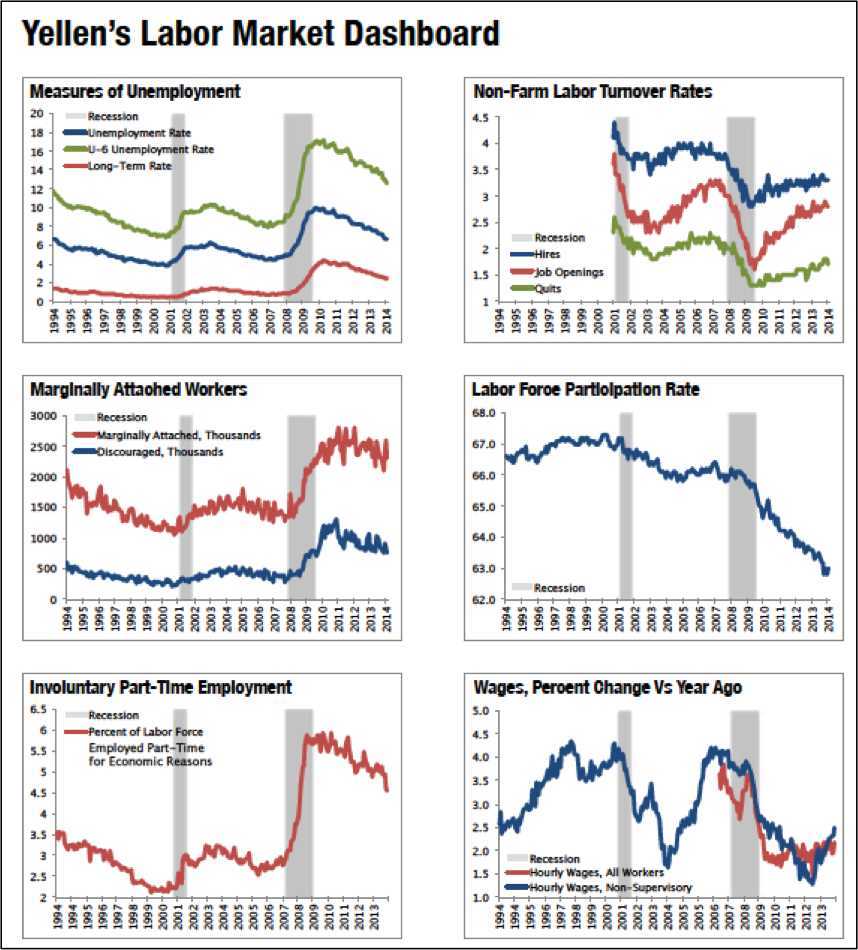

“Yellen monitors nearly a dozen indicators to assess the labor market’s health such as long-term unemployment and the quits rate—the number of workers leaving their jobs voluntarily in a month as a share of total employment. Together the indicators give a fuller picture of how U.S. workers have fared in the five years since the recession ended (see Figure 1).”

“Yellen has historically stressed less familiar measures of a labor market so shattered by the worst financial crisis since the Great Depression that the simple unemployment rate measure couldn’t sufficiently capture the situation. In a March 2013 speech to the National Association for Business Economics, she said that studying unemployment, payrolls, and labor force participation, as well as three gauges from the Bureau of Labor Statistics Job Openings and Labor Turnover Survey, offered a better guide. Later, at her first press conference as Fed chief, she added underemployment, long-term unemployment, and the job openings rate to her list (see Figure 2).”

Leveraging Multiple Metrics to Enhance Our Analytics

As discussed in my blog post Best Practices for Analytics Profiles, multiple measures or scores can provide more holistic, more accurate and ultimately more actionable insight into your organization’s “most strategic nouns” (e.g., customers, products, stores, employees, jet engines). In the analytic flow shown in Figure 3, we created an analytic profile for each customer comprised of multiple scores such as customer loyalty, customer advocacy, and life stage—coupled with additional measures such as tenure (length of time as customer) and average monthly purchases in order to improve customer retention (the key business initiative upon which we were focused for a particular Big Data engagement).

Let’s create another example of how one might employ different metrics to measure the financial condition of William Schmarzo. Measures on the William Schmarzo financial dashboard (and in the analytic profile of William Schmarzo) might include:

- FICO. Probably the most famous of all financial scores, FICO is a credit score developed by the Fair Isaac Corporation. Your FICO score is used by lenders to assess your credit risk and whether to extend you credit (e.g., credit card) or a loan (for a car or home). Using mathematical models, the FICO score takes into account the following factors: payment history, current level of indebtedness, types of credit used, length of credit history, and new credit applications. A person’s FICO score will range between 300 and 850. In general, a FICO score above 650 indicates that the individual has a very good credit history. People with scores below 620 will often find it more difficult to obtain financing at a favorable rate.

- Earnings Potential. This measure would be an estimate of my total earnings potential through the rest of my working career. It would consider my earnings history, future earnings trends, current and projected tax rates, the earnings potential in my industry and in my areas of expertise, and my projected retirement date. And it might even consider if I’d pursue a second career after retiring (e.g., consulting, teaching, coaching, executive tutoring).

- Wealth Accumulation Meter. This is a measure of how much wealth I have accumulated vis-à-vis a benchmark of others at a similar stage of life. It could consider my savings, investments, retirement accounts, social security, current home value (minus the mortgage amount), projected home value given the area of the country, and the value of any insurance policies.

- Savings Potential. This measure would look at my historical savings patterns, and project what I could save considering my earnings potential, estimated length of time in the jobs market, retirement plans, and financial obligations to my parents and children.

- Investment Performance. This measure would examine my historical investment performance, track my risk aversion (maybe yet another measure to include in my analytic profile), and consider long-term economic and demographic trends to project how my current investments and investment strategies might perform in the future.

- Children’s College Readiness. Since funding my children’s education is a significant financial burden, measuring my readiness for it would be critical. Components of this measure would include the age of my children, projected college costs given their subject areas of interest and potentially the colleges of interest (private versus public), current savings amount and mix, and my investment strategy for those savings.

- Retirement Readiness. This measure would ascertain my readiness for retirement including how much I have saved for retirement, retirement strategies, estimated retirement age, and different retirement scenarios (e.g., lots of travel, second career, vacations).

There are potentially many other variables (insurance coverage, physical health projections, mental health assessment, legacy/donation objectives, lottery luck, gambling prowess, etc.) that one might want to consider in measuring the overall financial health of William Schmarzo.

Summary

Summary

As Yogi Berra famously said, “It’s tough to make predictions, especially about the future.” But it is especially hard if you don’t have a realistic assessment of the current condition you are trying to measure and influence. As Janet Yellen demonstrates, you need multiple measures that provide different perspectives. Yes, many of these measures might be highly correlated, and you’ll want to understand the levels of cross-correlation[1] to make sure that you’re not inadvertently giving more weight to a measure than it deserves. But utilizing multiple variables, measures or scores will provide more holistic, more accurate, and ultimately more actionable insight into both your personal (e.g., financial health) and business (e.g., the United States jobs market) objectives.

[1] In statistics, cross-correlation refers to the correlations between two random variables X and Y.