Here we are as Dell, and we’re champing at the bit to show our customers, partners and the world what we’re made of as a combined business. We were already recognized as the leader in data storage pre-merger and together we’re going from strong to stronger, now number one across all combined mid-range markets in which we play. If you’re a customer or partner of either company this bodes well for you, as Dell can now offer an even greater choice of world-class products from a single vendor, which has become the largest privately controlled IT company in the world.

Since we started this journey nearly a year ago, we’ve had a number of questions from customers about our plans to support the midrange storage portfolios that are coming together. Let me confirm that we are 100% committed to supporting both EMC Unity and the Dell SC Series (Compellent) going forward. Why? Let’s start with a look at what both product lines have brought to the combined business and then fast forward to see what the future holds.

The Dell midrange businesses represent:

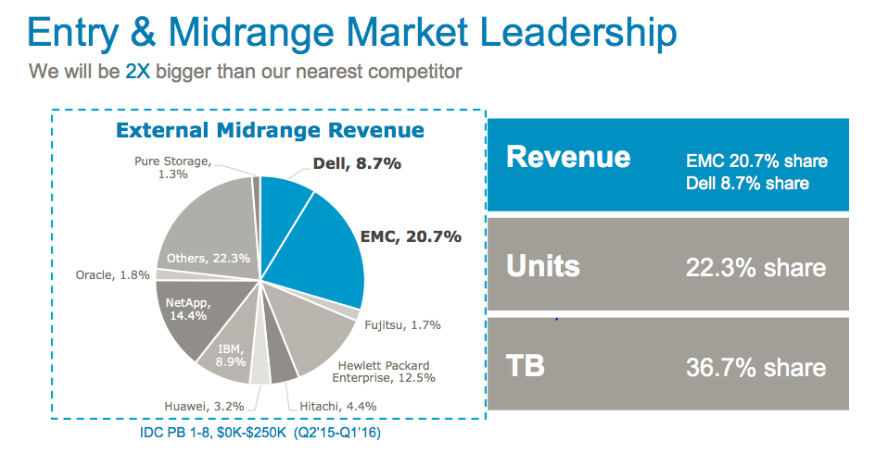

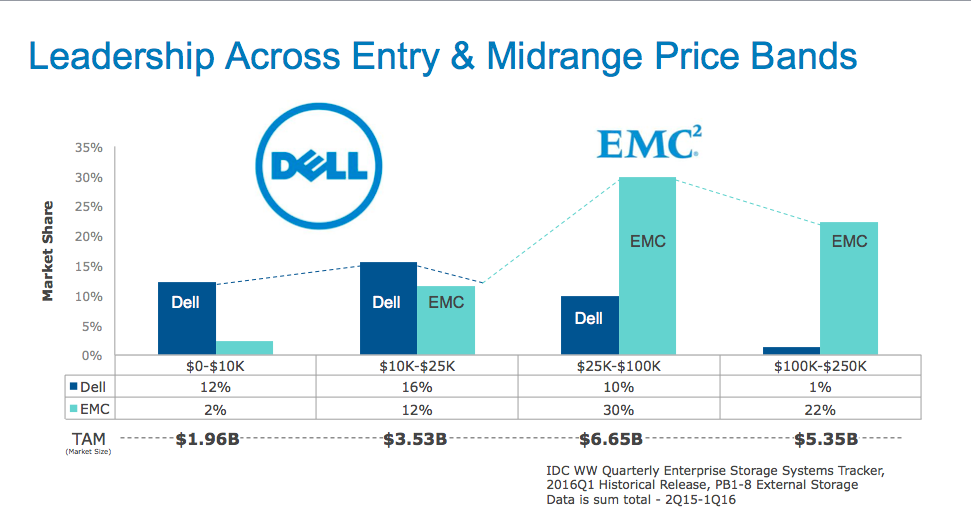

- Market share of 29.4%, nearly double that of our nearest competitor.

- Leadership across all price bands. [i]

- $5 billion in combined revenues [ii] within a total addressable market of more than $17 billion.

- More than 100,000 existing, passionate storage customers [iii], with the heritage of both EMC technologies well positioned in large enterprises and of Dell’s incredible strength in the entry-level and mid-markets.

The Combined Dell Midrange Portfolio – Go Forward from Today

Dell’s midrange portfolio now has a scale and breadth that is without comparison in our industry. Our combined midrange offerings are the strongest they’ve ever been as, this year, we have launched new products such as Unity Flash storage systems and made powerful enhancements to the SC Series OS. This all adds up to a combined portfolio for our customers and partners that is unmatched elsewhere in the industry.

Portfolio Approach = A Win-Win for Customers and Partners

While single “point solutions” may be temporarily viable for one-trick, cash-burning startups and niche players, neither Dell, nor EMC has ever believed ‘one-size fits all’ is the best approach because it limits choice and flexibility. It’s not about us; it’s about our customers, so we focus on offering a continuum of solutions. This means we’re able to tailor our offerings for specific customer needs, by combining unique capabilities from across our broad portfolio. As Dell, we can bring customers an even deeper portfolio approach to midrange storage. Together, we can ensure choice of the right product for an even wider spread of our customer’s needs at the optimal price and performance, now covering almost any use case.

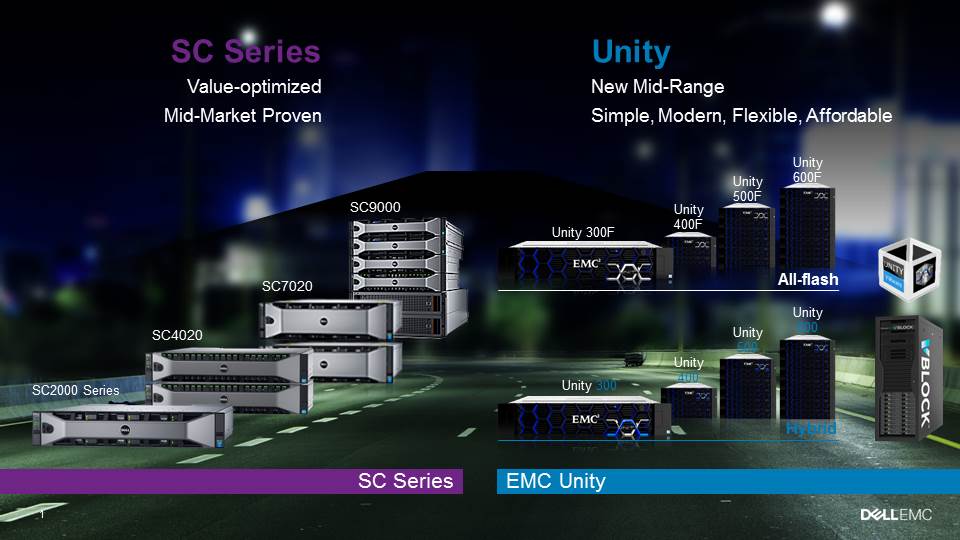

As a combined business, Dell is the midrange segment leader in market share and offers two strong and distinct product families that meet customer needs from entry-level into upper midrange storage. For the sake of simplicity, let’s refer to them as Dell SC Series and EMC Unity. There are clear distinctions in both the use cases and scale that each product family addresses.

SC Series: Value-Optimized Mid-Market Proven Storage Systems

The Dell SC Series is a value-oriented family with a proven track record in many small and medium businesses. In analyzing the SC customer base, we’ve seen distinct areas of strength where Dell is the server vendor. Focused on value and ease-of-use, the automated data placement and data efficiency features provide performance at a low price. The range of configurations includes all-flash, hybrid and disk-only configurations. Ideally suited to smaller deployments across a variety of workloads, the SC Series products are easy to use and value optimized. We will continue to optimize the SC Series for value and server-attach.

Unity Family: The Ultimate in Simple, Flexible, Unified Storage

The EMC Unity family is able to address most general-purpose midrange customer requirements for block, file, and unified workloads with configurations for all flash, converged, hybrid and virtual deployments. The Unity architecture will continue to be optimized for simplicity, flexibility and affordability. In just a few more weeks, we will announce a powerful Unity code update to expand its all-flash data services, increase its category-leading density and provide advanced cloud services.

With such incredible assets and customers, the Dell strategy is to retain both product families and continue investing in them according to their strengths. That benefits us, because it benefits our customers. It’s a strategy we believe supports customer choice and leaves no gaps for the competition.

While we are leading with Unity and SC Series for our midrange customers going forward, we will continue to support our N-1 platforms from both Dell and EMC. Customers can continue with their current products and then choose to evolve over time as Dell invests more in seamless management and mobility across our product set.

For migration, management and mobility, we’ve got our customers covered. We already have EMC ViPR Controller – which is a common storage management platform across multi-vendor storage arrays. In addition, we have world-class data protection across Dell and EMC storage with EMC Data Domain, EMC Avamar, and EMC NetWorker. EMC RecoverPoint and EMC VPLEX can also be used today for replication between Unity and SC Series to facilitate easy coexistence and data mobility.

Bottom line

Dell is better together, and we’re making sure that this is true most of all for our customers, who will be able to stick with what is most familiar and comfortable for them. Both Unity and SC Series product families will continue well into the future with support and R&D that will further develop their capabilities to handle the most diverse set of midrange use cases and workloads. The level of quality, product functionality and support that our customers have come to trust and appreciate will be a minimum baseline for Dell today, and it will be the foundation from which we will exceed customer expectations in the future.

[1] IDC WW Quarterly Enterprise Storage Systems Tracker, 2016Q1 (combined separate Dell and EMC Entry and Midrange External Storage Market Share figures)

[1] According to Dell and EMC company data

[1] According to Dell and EMC company data