By now, you’ve all heard how Software Defined Storage (SDS) is reshaping the storage industry (and use case) landscape. The market gets it and increasingly users are embracing this new, “disruptive” technology by introducing it to their enterprise data centers or using it to create hyper-scalable virtualized infrastructures for cloud applications. After all, the appeal of installing software on individual commodity host application servers to create a virtual storage pool (i.e., “server SAN”) from each participating server’s excess direct attached storage (DAS) without requiring additional specialized storage/fabric hardware is alluring…and almost too good to be true.

Throw in the added synergy and side benefits like ‘on-the-fly’ elasticity; linear I/O processing performance capacity scalability; simplicity and ease of use; hardware/vendor agnosticism and unparalleled storage platform flexibility and you might think “SDS server SAN” technology can solve world hunger too. Well, if not world hunger, perhaps today’s contemporary data centers’ thirst for a simpler, less expensive higher performing and more flexible storage solution for block and/or object….

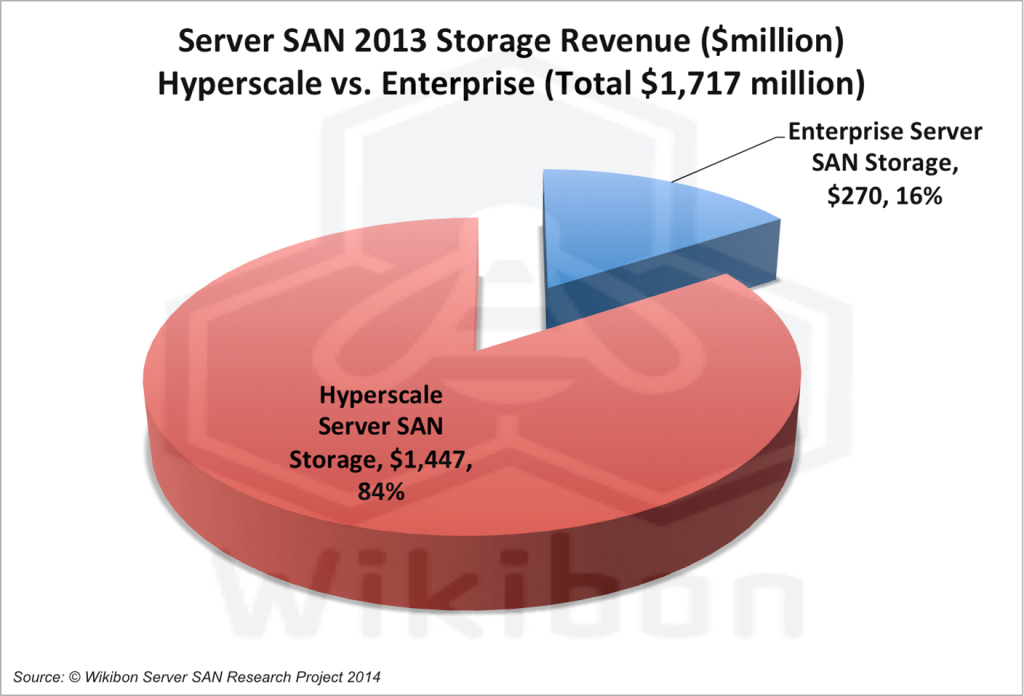

Yes. There’s a lot of excitement, market activity and hype out there around SDS and Server SANs in general. But don’t take my word for it. Though data compilations for CY 2014 aren’t available yet, Wikibon’s market TAM and SAM sizings for 2013 are revealing.

Figure 1. Hyperscale vs Enterprise

Figure 2. Vendor SOM (share of market)

Figure one shows that (at least for 2013) the application of “Hyperscale” Server SAN’s (i.e., Petabyte Scale) generated far greater revenue than “Enterprise” Server Server SAN’s. Why? New VSI (Virtual Server Infrastructure) and Cloud use cases are ideally suited for the hyper-converged, hyper-scalability attributes SDS Server SAN’s bring to the table. This is, in fact, a primary targeted use case for ScaleIO. Why are Enterprise Server SAN’s a lot less than Hyperscale Server SANs? This is the domain of the mission critical apps, databases and use cases that keeps IT Datacenter Directors and Administrations busy….and up at night. It’s also the domain of traditional storage arrays and the Storage Admins, with lots of proprietary equipment (and bias) for vendors like EMC and our esteemed competitors. These folks are wary and cautious when it comes to new technologies. They’re not enthusiastic early adopters. But as new technology and products mature and prove themselves, they end up being embraced by IT data center departments. “Show me your value prop” or …”Show me the money.” And simple, less complex storage solutions will get you in the door. Growth is expected to be high in this hardware ‘open’ and ‘liberated’ segment over time.

Figure 2 shows the major players in the Server SAN arena. Note that VMware’s SOM is tiny…but this is because VMware’s Virtual SAN (VSAN) wasn’t fully rolled out in the market place. But also note the number of players. Big players and small unknowns alike. All vying for the coveted Enterprise Server SAN market, which is poised for growth along with the SMB and ROBO segments.

By now, you’re ready to call me out on my liberal use of SDS and Server SANs terminology. After all, figure 2 lists hyper-converged Server SAN hardware appliance vendors (like Nutanix & Simplivity) along with pure software SDS vendors and products (like Scality, ScaleIO, Scale Computing, etc.). So what gives?

In my mind — more importantly in the minds of storage industry consultant and analyst thought leaders – the term Server SANs encompasses both converged hardware appliances and pure SDS architectures and products. The difference between the two are primarily packaging (i.e., bundled with hardware or not). Both rely on software to create a virtual Server SAN of aggregated, pooled storage from application host servers or virtualized storage servers (i.e., those dedicated appliances).

There are pluses to both product design/implementation types. The key with a pure SDS platform like ScaleIO and VSAN, however, is that users can allocate, repurpose or leverage their existing commodity host application servers and excess DAS storage capacity to form a Server SAN – without purchasing a separate/dedicated Server SAN appliance (i.e., “storage server”). Simple and easy…and much more flexible to integrate, expand and maintain with a variety of mixed, heterogeneous and asymmetrical hardware configurations and storage pools/tiering. Greater performance and capacity scalability too… (ScaleIO scales to 16PB raw). This is why ScaleIO is extremely well-suited for Cloud use cases – whether they be Private or Public. But pure SDS systems are equally well-suited – and nicely positioned — for Enterprise Server SANs too. Even ROBOs and SMBs can benefit from low TCO SDS platforms.

You also frequently see the term “hyper-convergence” when describing Server SANs or SDS systems. What do we mean by “hyper-converged” and why is that important? Simply put, a hyper-converged storage infrastructure combines application, compute, network/comm and storage all in the same appliance box or host application server resources “virtual layer”. This means more efficient use of rack space, power and “local” hardware resources (CPU, Storage, Comm); all in a single layer closest to the application and host CPU enhanced by a peer-to-peer grid.

The future is hyper-convergence based on Server SAN and virtualized/abstracted SDS with simple centralized advanced management and monitoring facilities – running on commodity hardware. ScaleIO is software defined storage … with lower case ‘sds’ … for block data. On the other hand, federated and unified software defined ViPR Controller is in all caps – SDS. More accurately, it’s a Software Defined Data Center (SDDC) platform for managing the entire datacenter storage HW resource layer underneath it.

In closing, I leave you with the following projections for “Traditional Storage” versus Server SAN TAM growth over time contained in Figure 3 below. Storage market growth – at least how Wikibon sees it – is clearly with Server SANs and this is why EMC is investing and focusing on them. EMC has or will have all the bases covered with converged storage appliances (ECS), sds (ScaleIO) and SDDC (ViPR Controller) platforms; and will continue to give our customers rich choices across the storage platform/architecture spectrum!