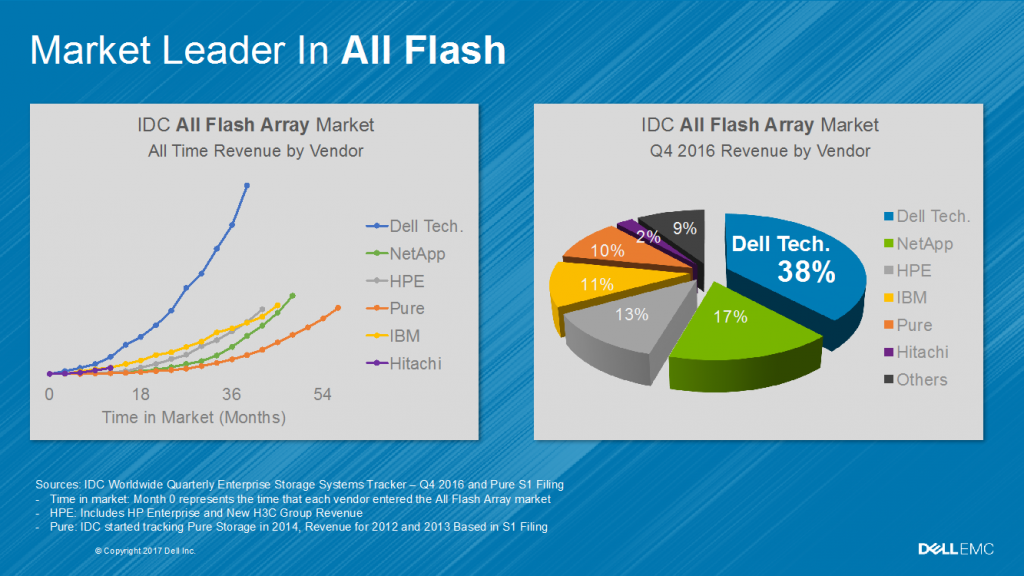

During 2016, the “Year of All Flash”, Dell shipped more than an Exabyte of all-flash array capacity[i]. As a market and innovation leader in enterprise storage for decades – Dell ironically was considered to be a bit late to the ‘All Flash’ storage market. Today we’re taking share from our competitors and growing revenues faster than the all-flash storage market according to IDC. Dell Technologies’ all-flash revenue growth is 72.1 percent, versus the 61.2 percent growth for the overall all-flash storage market[ii].

In fact, this month marks the one-year anniversary of Dell’s VMAX All Flash array. In 2016, we introduced the VMAX 450F and VMAX 850F then the VMAX 250F, inline compression and non-disruptive migration. During this transformative year, the VMAX business grew bookings of VMAX All Flash from 21 percent in Q1 2016 to approximately 70 percent in Q3, 2016 with continued progress in Q4.[iii]

Thanks to a powerful portfolio of VMAX All Flash, XtremIO and Unity All Flash, Dell has expanded its position as the undisputed leader of the all-flash enterprise storage market with greater than 2x the market share of the closest all-flash array vendor. This is according to the latest results of IDC’s Enterprise Storage Systems Tracker published on March 3, which labels Dell as Dell Technologies.[iv]

More importantly, Dell’s all-flash portfolio enables customers to run their businesses more efficiently and effectively by modernizing their storage infrastructure. For example, Fresenius Medical Care a leading provider of lifesaving dialysis, moved off HPE 3PAR to Dell VMAX All Flash and was able to reduce their data center footprint by 85 percent[v]. Check out this video testimonial to learn how Fresnius did it with Dell.

Thanks to this type of transformation, it’s no surprise that by 2020, IDC forecasts “All Flash” to grow to an $8.9 billion market, surpassing traditional hard disk arrays[vi]. All-flash already accounted for 26 percent of total external storage spending during the last quarter of 2016. As a market leader, Dell is working to drive this transition even faster and will continue to evolve our all-flash portfolio to provide the transformative value of flash into all parts of the data center.

This includes our recent introduction of Isilon All Flash and flash-enabled Data Domain – bringing flash to unstructured data as well as protection storage. It also includes the mainstreaming of the DSSD technology across our all-flash portfolio, which will help accelerate our innovation in all flash. Finally, we are set to introduce our first storage system with NVMe by the end of this year.

Dell’s broad expertise and deep portfolio approach is critical to helping our customers transform IT. For example, some of our largest traditional VMAX customers now purchase Dell ScaleIO software-defined storage that support all-flash configurations for their data center scale workloads to gain incredibly simple storage lifecycle management. Likewise, we have numerous VMAX customers who have implemented Dell XtremIO for the efficiency of iCDM and deduplication.

After an incredible 2016, Dell is on a mission to make flash the de facto standard for enterprise storage. Flash is faster; it’s more reliable, simpler and more cost effective from an overall TCO perspective. That’s why we believe that ‘flash is the new normal’ and as the market evolves, more focus will be on a vendor’s ability to help transform their customer’s infrastructure into a truly modern data center. So buyer beware of companies that claim they can solve all your problems with a single all-flash array. Partner instead with a company that can tailor a solution to meet your modern data center needs for today and tomorrow.

[i] Effective capacity based on Dell actuals with an assumed efficiency ratio

[ii] IDC Worldwide Quarterly Enterprise Storage Systems Tracker – Q4 2016, March 3, 2017

http://www.idc.com/getdoc.jsp?containerId=prUS42311917. IDC tracks the All Flash Array market at the vendor group level, shares cited are for Dell Technologies.

[iii] According to Dell internal business data

[iv] IDC Worldwide Quarterly Enterprise Storage Systems Tracker – Q4 2016, March 3, 2017

http://www.idc.com/getdoc.jsp?containerId=prUS42311917. IDC tracks the All Flash Array market at the vendor group level, shares cited are for Dell Technologies.

[v] According to customer data: http://www.emc.com/video-collateral/demos/microsites/mediaplayer-video/dellemc-fresenius.htm