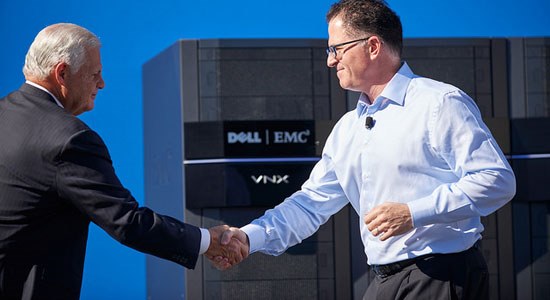

Sixty days ago we announced a landmark transaction to combine Dell and EMC to create an enterprise technology powerhouse with the values of a startup: innovative, nimble, and customer-centric.

As we move forward, you are our only focus, inspiration and measure of success. The combination of Dell and EMC will position us to create more customer and partner value than any technology solutions provider in the industry. We’ll be best positioned to maximize legacy investments with leadership in storage, servers, virtualization and PCs. And best positioned to build a bridge to the future through leading innovation in digital transformation, software-defined data center, converged infrastructure, hybrid cloud, mobile and security. In fact, as a combined company, Dell and EMC will have leadership positions in 22 Gartner Magic Quadrants.

This is our time to accelerate the development of groundbreaking new technologies that will support you in a connected world that is ripe with opportunity and disruption. We believe that a strategically-aligned family of businesses will be the best structure to remain nimble, innovative, and maintain the independent partner ecosystems of Dell, EMC, VMware, VCE, Virtustream, RSA, Pivotal and the balance of the Dell and EMC companies.

As we think about the coming New Year, we are making three resolutions today:

- To make you, our customers and partners, the core of everything we do. Everything we do is designed for your success. With the combination of Dell and EMC, we will continue to advocate for choice and long-term investment value, working with open, flexible, scalable design just as we have since Dell began 31 years ago.

- To accelerate innovation. Combining Dell and EMC means uniting some of the best minds in the industry and pushing ourselves to develop stronger, more powerful, more innovative solutions for your business. We will implement an innovation strategy for each business that will allow it to reach its full potential. Together, Dell and EMC will place a premium on innovation and R&D, and world-class partnerships to help you achieve your dreams.

- To create a future where we can do incredible things. Our future will build on the foundation of EMC’s deep relationships with large enterprises across the Fortune 1000 combined with Dell’s strength in the midmarket and small business sector. Today, Dell is the only provider of end-to-end IT solutions and is gaining share across core sectors outpacing the market, and financially strong. This trajectory will continue with the integration of EMC’s assets. In the future, our technology will create jobs, hope and opportunities on a global scale. The possibilities are limitless.

We want you to be as excited as we are by the possibilities of a combined Dell and EMC. This is literally – and figuratively – a big deal, and the quintessential example of how Dell is investing in you, our customers, for the long-term. Together we are focused squarely on the future and helping you realize the enormous opportunities that lie ahead. Our vision is shared, our portfolios complementary and our talent unlimited.

Disclosure Regarding Forward Looking Statements

This communication contains forward-looking statements, which reflect Denali Holding Inc.’s current expectations. In some cases, you can identify these statements by such forward-looking words as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “confidence,” “may,” “plan,” “potential,” “should,” “will” and “would,” or similar expressions. Factors or risks that could cause our actual results to differ materially from the results we anticipate include, but are not limited to: (i) the failure to consummate or delay in consummating the proposed transaction; (ii) the risk that a condition to closing of the proposed transaction may not be satisfied or that required financing for the proposed transaction may not be available or may be delayed; (iii) the risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained, or is obtained subject to conditions that are not anticipated; (iv) risk as to the trading price of Class V Common Stock to be issued by Denali Holding Inc. in the proposed transaction relative to the trading price of shares of VMware, Inc. common stock; (v) the effect of the announcement of the proposed transaction on Denali Holding Inc.’s relationships with its customers, operating results and business generally; and (vi) adverse changes in general economic or market conditions. Denali Holding Inc. undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Additional Information and Where to Find It

This communication does not constitute an offer to sell or a solicitation of an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. This communication is being made in respect of the proposed business combination transaction between EMC Corporation and Denali Holding Inc. The proposed transaction will be submitted to the shareholders of EMC Corporation for their consideration. In connection with the issuance of Class V Common Stock of Denali Holding Inc. in the proposed transaction, Denali Holding Inc. will file with the SEC a Registration Statement on Form S-4 that will include a preliminary proxy statement/prospectus regarding the proposed transaction and each of Denali Holding Inc. and EMC Corporation plans to file with the SEC other documents regarding the proposed transaction. After the registration statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to each EMC Corporation shareholder entitled to vote at the special meeting in connection with the proposed transaction. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS RELATING TO THE TRANSACTION FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors may obtain copies of the proxy statement/prospectus (when available) and all other documents filed with the SEC regarding the proposed transaction, free of charge, at the SEC's website (http://www.sec.gov) or from Denali Holding Inc.’s website (http://www.dell.com/futurereadydell).

Participants in the Solicitation

Denali Holding Inc. and certain of its directors and executive officers may be deemed to be “participants” in the solicitation of proxies from EMC Corporation shareholders in connection with the proposed transaction. Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of EMC Corporation shareholders in connection with the proposed transaction and a description of their direct and indirect interest, by security holdings or otherwise, will be set forth in the proxy statement/prospectus filed with the SEC in connection with the proposed transaction.